[ad_1]

Citigroup CEO Jane Fraser said Monday that consumer behavior has diverged as inflation for goods and services makes life harder for many Americans.

Fraser, who leads one of the largest U.S. credit card issuers, said she is seeing a “K-shaped consumer.” That means the affluent continue to spend, while lower-income Americans have become more cautious with their consumption.

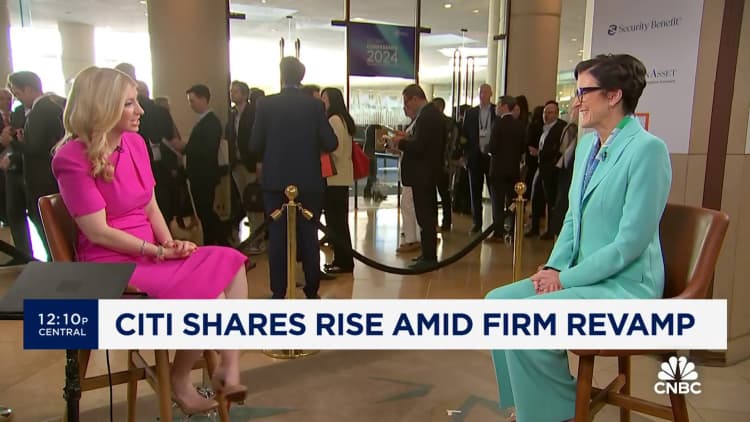

“A lot of the growth in spending has been in the last few quarters with the affluent customer,” Fraser told CNBC’s Sara Eisen in an interview.

“We’re seeing a much more cautious low-income consumer,” Fraser said. “They’re feeling more of the pressure of the cost of living, which has been high and increased for them. So while there is employment for them, debt servicing levels are higher than they were before.”

The stock market has hinged on a single question this year: When will the Federal Reserve begin to ease interest rates after a run of 11 hikes? Strong employment figures and persistent inflation in some categories have complicated the picture, pushing back expectations for when easing will begin. That means Americans must live with higher rates for credit card debt, auto loans and mortgages for longer.

“I think, like everyone here, we’re hoping to see the economic conditions that will allow rates to come down sooner rather than later,” Fraser said.

“It’s hard to get a soft landing,” the CEO added, using a term for when higher rates reduce inflation without triggering an economic recession. “We’re hopeful, but it is always hard to get one.”