[ad_1]

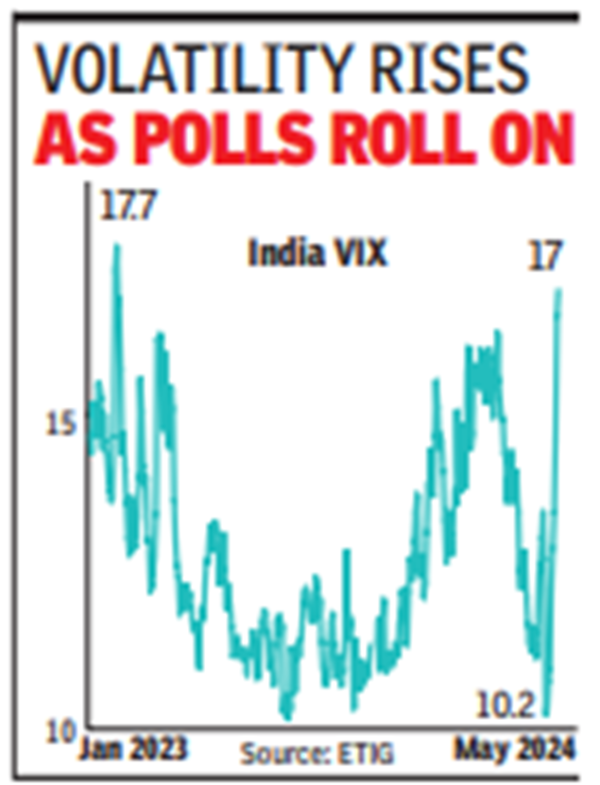

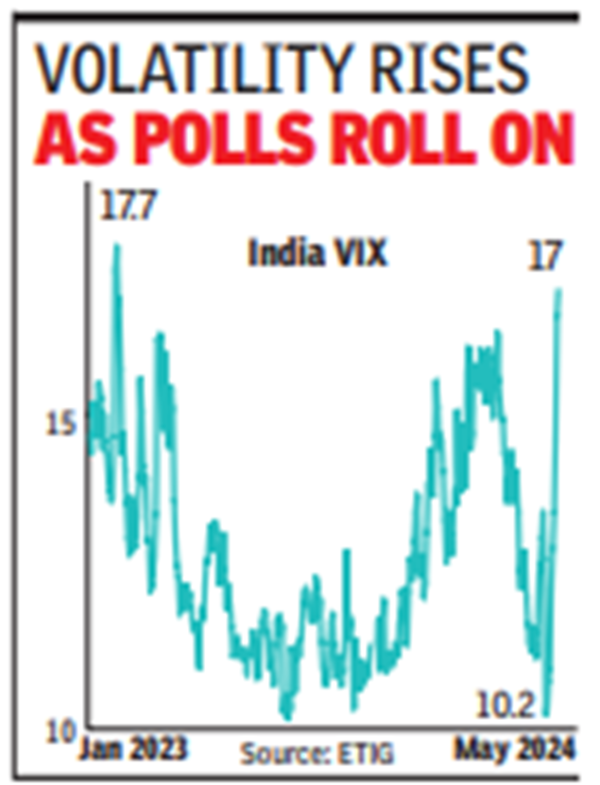

Mumbai: Election-related volatility is impacting Dalal Street sentiment, which is reflected in volatility index India VIX’s 70% surge in 10 sessions. From a nine-month low level of 10.2 on April 23, India VIX jumped to 17 on Tuesday – the highest level since Jan 2023 – ETIG data showed. A volatility index is also known as a ‘fear index‘.

What is the reason for the spike? According to market players, investors are buying options to minimise any results-related risks instead of liquidating their portfolio ahead of results on June 4.Recent RBI actions against Kotak Bank, and tougher project finance norms too unnerved the market and abetted volatility, adding to the spike, traders said.

What is the reason for the spike? According to market players, investors are buying options to minimise any results-related risks instead of liquidating their portfolio ahead of results on June 4.Recent RBI actions against Kotak Bank, and tougher project finance norms too unnerved the market and abetted volatility, adding to the spike, traders said.

India VIX is “a measure of expected volatility in the market over the next few weeks”, said Manish Chowdhury of broking firm StoxBox. The measurement of this index is based on a mathematical equation called the ‘Black Scholes Merton Model’ that won a Nobel Prize for two of its authors.

Before the elections started on April 19, market players were betting on a resounding victory for the ruling BJP-led alliance with over 400 seats. tnn