[ad_1]

Indian stocks are set for the biggest monthly outflow in nearly a year as election uncertainties and high valuations prompt some funds to shift to cheaper alternatives like Chinese equities.

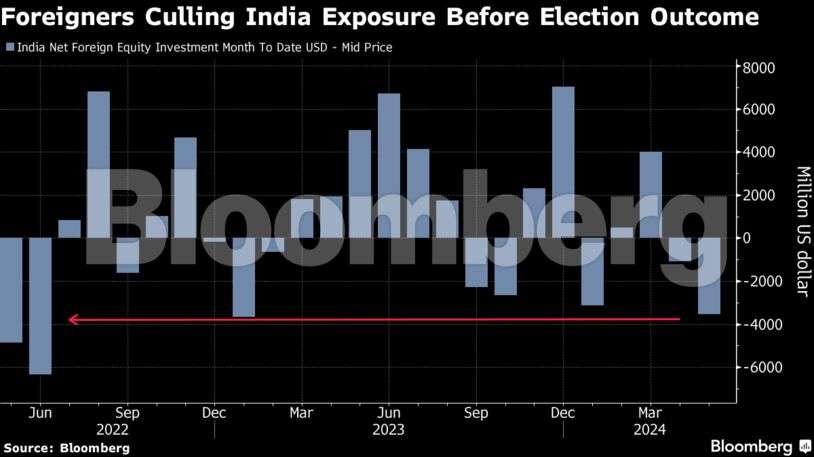

Global investors have pulled a net $3.5 billion from India’s stock markets so far in May, on course for the biggest withdrawal since June 2023, according to data compiled by Bloomberg.

The outflows signal concern that a less decisive performance by Prime Minister Narendra Modi may limit his ability to carry out crucial economic reforms. The uncertainty has dampened the appeal of expensive Indian equities, while cheaper Chinese stocks have started to look more attractive.

“The risks around this election have increased in India, whereas there are signs the downside in China may not be as bad as feared,” said Christine Phillpotts, a portfolio manager at Ariel Investments LLC in New York. “The valuation gap between the Indian and Chinese markets may have become too large for foreign investors to ignore.”

India concluded the fourth phase of voting in its marathon elections on Monday, with the weekslong polling to end on June 1. The votes will be counted on June 4.

Modi is still widely expected to secure a third successive five-year term with the leader having predicted that his Bharatiya Janata Party and its allies will win more than 400 of the 543 seats up for grabs in the lower house of parliament.

And some market participants say the budding rotation to Chinese stocks from India is likely to stall. Citigroup Inc. last week downgraded China’s equities to neutral and upgraded India to overweight, citing the two nation’s diverging earnings outlook.

Still, the rally in battered Chinese stocks has started to broaden.

The MSCI China Index surpassed the MSCI India in year-to-date performance earlier this month. Yet, the gauge for China stocks trades at nearly half the valuation of its India counterpart on their respective 12-month forward earnings estimate.

Money has started coming in droves to China’s technology stocks, with billionaire investors such as Michael Burry and David Tepper loading up on stakes in a gamut of companies in the first quarter of 2024.

Given China and India are the biggest markets in the EM Universe, “selloffs in India lead to money going to China and vice versa,” said Arjun Jayaraman, a head of quantitative research at Causeway Capital. “So we could see some more of that.”